“The economy, stupid.” This is the famous quote (often mistakenly rendered as “It’s the economy, stupid.”) coined by Bill Clinton’s Campaign Director James Carville in 1992, alluding to recessionary conditions at the time of the election. We all know how that played out. As we enter an election year in 2020, it may be fitting to flip that statement into this question: “Is it the economy?”

Some say the re-election of an incumbent U.S. president hinges largely on the economy. A recent analysis piece published by Morgan Stanley showed the over the past century, an incumbent was re-elected in each instance when a recession didn’t occur in the previous two years; the only exception being Calvin Coolidge who kept his position in 1924 despite a recession.

But what does the data say about the impact that election years have on the economy? One school of thought says uncertainty surrounding elections can lead to a reduction in economic activity as businesses often delay large purchases or investments during this time.

Hop Mathews, economic analyst, and Azhar Iqbal, econometrician from Wells Fargo Securities recently authored a special commentary piece on the topic. What they found was that over the past 70 years election years do not appear to be statistically different from those preceding or following. In fact, their research found that election years often exhibit higher rates of growth and investment.

Checking the pulse of its customers on the topic, Ryerson recently asked if the upcoming presidential election will have an impact on their business. While roughly 30% said it would indeed have an impact (6% anticipate a stronger year, 23% a weaker year), more than half believed it all will depend on the results in November.

.ashx)

Truth be told, it can often be difficult to separate the effect of elections from other macroeconomic factors and/or economic policy uncertainty. One example of this uncertainty is the impact of Section 232 tariffs on steel and aluminum imports imposed by the Trump Administration in early 2018.

Roughly 67% of respondents to the Ryerson survey anticipated tariffs will have some type of impact on business in 2020. While this is improved compared with the 82% that anticipated an impact headed into 2019, it is still a significant factor in business.

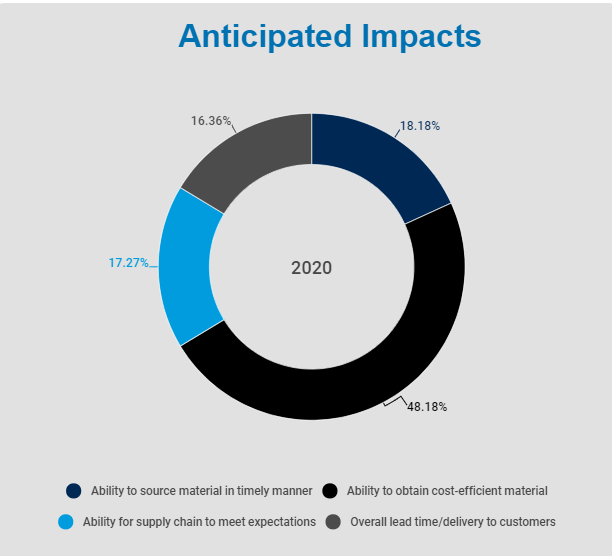

The anticipated impacts of tariffs haven’t changed much from year to year. The top-two concerns, according to respondents, are the ability to source material in a timely manner and the ability to obtain cost-efficient material—the same as they were headed into 2019.

In all, the market faces many challenges headed into 2020. Whether a presidential election further intensifies these challenges is unclear, but it adds another layer to business planning for the foreseeable future.

.ashx?h=300&w=940&hash=71E0E1C301D05C446BAA7B69C09DBA49)