CHICAGO – May 6, 2020 – Ryerson Holding Corporation (NYSE: RYI), a leading value-added processor and distributor of industrial metals, today reported results for the first quarter ended March 31, 2020.

Q1 2020 Highlights:

Management Commentary

Eddie Lehner, President and Chief Executive Officer of Ryerson said, “I want to begin by first thanking all of the COVID-19 pandemic frontline workers who are tirelessly responding to the pandemic with tremendous grace and courage as they treat, care for and comfort the afflicted. I next want to thank, in these unparalleled and trying times, my Ryerson colleagues who understand the shared sacrifice required during this crisis and who have risen to the challenges imposed by the virus with grit, determination and solidarity. During the era of COVID-19, we are working in common cause and with great appreciation for our customers and suppliers as we strengthen these vital relationships and work through the complications of an economic shutdown without precedent. As an “essential business,” we are privileged and honored to be an integral part of supply chains that are providing life-saving and essential products and services that are supporting the critical and ongoing needs of society and the economy. As we work through the acute shocks caused by the pandemic, there are three distinct periods to address: BCV (Before the Coronavirus), DCV (During the Coronavirus) and ACV (After the Coronavirus). Turning to our first quarter performance, which began BCV, we delivered commendable results during a quarter that felt like three different years compressed into three months. January started slowly given demand weakness within key original equipment manufacturer, or OEM, verticals. Then, the pandemic tidal wave which gripped China in January and February exponentially spread and paralyzed North America in March. Distilling the first quarter reflective of BCV and DCV, we prepared our organization and implemented plans, policies and practices to safeguard the health and safety of our workforce. Safety performance was excellent throughout Ryerson in the quarter, as was COVID-19 adaptiveness and responsiveness. Our operations team delivered great customer experiences safely as Ryerson operated as an essential business and our operators shone brilliantly given the challenges posed by the global and national health emergency. Ryerson executed upon organizational priorities during the quarter by repurchasing $55 million of our Senior Secured Notes at an average price below par, decreasing net debt and cash interest expense, generating significant cash flow from operating activities, and continuing to build net book value of equity. At the same time, the turnaround progress at Central Steel & Wire, or CS&W, was demonstrated in the company’s first quarter results, as carbon margins recovered to mid-cycle levels and additional post-acquisition synergies were realized. For Ryerson overall, transactional business was better than OEM program business and carbon gross margins were stronger than aluminum and stainless margins. Also affecting gross margins and Adjusted EBITDA, excluding LIFO was a mark-to-market customer hedging loss of $4.9 million, which negatively impacted gross margins, excluding LIFO by 50 basis points in the first quarter. However, this hedging loss is expected to be recovered as the physical metal ships in succeeding periods. All in all, our ability to adapt quickly to pandemic induced events and to execute DCV plans effectively is a tribute to our organization, our customers and suppliers in recognizing with clarity the gravity of circumstances created by COVID-19. Please know that our work continues indefatigably as we manage through the crisis and take the actions necessary to serve our dual mandate of safeguarding the health and safety of our employees while preserving liquidity and recovery capacity through the crisis interval and aftermath knowing that the duration of the virus and its impacts remain unknown. With respect to ACV, we remain hopeful and determined that as we collectively accelerate learnings about the virus and continue building virus response infrastructure to combat and eventually eradicate the virus, we will see societal and economic conditions normalize to the better side of current projections. We look forward to seeing all of you safe and well as we all work in common cause toward better and easier times.”

First Quarter Results

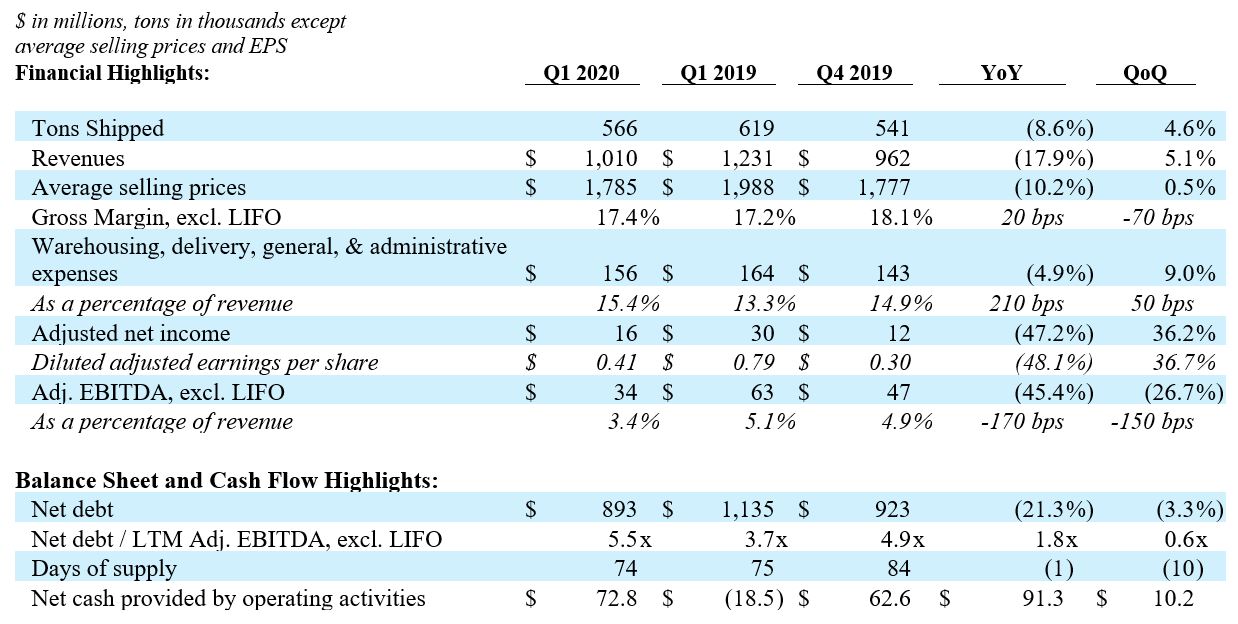

Ryerson achieved revenues of $1.01 billion in the first quarter of 2020, a decrease of 17.9 percent compared to $1.23 billion for the same period last year, with average selling prices down 10.2 percent and tons shipped down 8.6 percent. Gross margin expanded to 19.4 percent, compared to 18.8 percent in both the first and fourth quarters of 2019. Included in first quarter 2020 cost of materials sold was LIFO income of $20.2 million, compared to LIFO income of $6.5 million in the fourth quarter of 2019, and LIFO income of $20.1 million in the first quarter of 2019. Excluding LIFO, gross margin was 17.4 percent in the first quarter of 2020 compared to 18.1 percent in the fourth quarter of 2019, and 17.2 percent in the first quarter of 2019. A reconciliation of gross margin, excluding LIFO to gross margin is included below in this news release.

In the first quarter of 2020, Ryerson reduced warehousing, delivery, selling, general, and administrative expense by $8.0 million, or 4.9 percent compared to the year-ago period, driven by reductions in staffing related expenses. Warehousing, delivery, selling, general, and administrative expenses as a percentage of sales rose by 210 basis points year-over-year as revenue declines ran ahead of expense take-outs given COVID-19 impacts that subverted 2020 BCV business plan expectations around price and demand.

Net income attributable to Ryerson Holding Corporation was $16.4 million, or $0.43 per diluted share, in the first quarter of 2020 compared to $29.5 million, or $0.78 per diluted share, in the prior year period. Adjusted net income attributable to Ryerson Holding Corporation, excluding restructuring and other charges, gain or loss on retirement of debt, and the associated income taxes on these items, was $15.8 million for the first quarter of 2020, or $0.41 per diluted share compared to $29.9 million, or $0.79 per diluted share, in the prior year period. Ryerson achieved Adjusted EBITDA, excluding LIFO of $34.4 million in the first quarter of 2020, a decrease of $28.6 million compared to the first quarter of 2019, and a decrease of $12.5 million compared to the fourth quarter of 2019. A reconciliation of Adjusted net income to net income attributable to Ryerson Holding Corporation and Adjusted EBITDA, excluding LIFO to net income attributable to Ryerson Holding Corporation is included below in this news release.

Liquidity & Debt Management

At the end of the first quarter of 2020, Ryerson had 74 days of supply in inventory, down from 84 days at the end of the fourth quarter. On a same-store basis excluding CS&W, Ryerson had 72 days of inventory supply in the first quarter, compared to 81 days at the end of the fourth quarter. Working capital management in the quarter was excellent. Ryerson will continue working with customers and suppliers to bring inventories in-line with expected sharp demand declines as it moves through the second quarter while managing accounts receivable and accounts payable risk given current stresses throughout the supply chain.

Ryerson generated $72.8 million in cash from operating activities in the first quarter of 2020, compared to a use of $18.5 million in the year-ago period. Ryerson also repurchased $54.6 million of its outstanding Senior Secured Notes at an average price of $98.5. The repurchase transactions were funded through a combination of restricted cash, which is a portion of the proceeds generated through the sale-leaseback transaction completed in the fourth quarter of 2019, and the company’s unrestricted operating cash flows. As of March 31, 2020, Ryerson retained total liquidity of $396 million, compared to $439 million as of December 31, 2019.

Corporate Controller and Chief Accounting Officer Molly Kannan said, “During the first quarter, Ryerson generated significant counter-cyclical cash flow and continued to deleverage the balance sheet through repurchasing approximately $55 million of outstanding Senior Secured Notes at a discount to par value, which is expected to result in annualized interest expense savings of approximately $6.1 million. At the same time, we reduced our net debt by $30 million compared to the fourth quarter of 2019. In response to COVID-19, we are carefully monitoring our liquidity and projected working capital requirements by actively managing our receivables and payables cycles and decreasing inventory purchases and warehousing, delivery, selling, general and administrative expenses in-line with demand.”

Outlook Commentary

At this point in the second quarter, demand conditions have been impacted by temporary customer closures in-line with stay-at-home orders and virus driven demand shocks. North American April shipments trended 25 percent below March levels while the pricing environment has held up better than anticipated given faster than historical supply side responses to decreased demand as well as commodity prices that were already below their historical ten-year averages going into the pandemic.

Due to the macroeconomic uncertainty stemming from the coronavirus pandemic and overall lack of visibility into future demand trends, metal pricing and market conditions in the end-markets in which Ryerson operates, the Company will not provide guidance for the second quarter ending June 30, 2020.

Earnings Call Information

Ryerson will host a conference call to discuss its first quarter results Thursday, May 7, 2020 at 10 a.m. Eastern Time. Participants may access the conference call by dialing 833-241-7253 (Domestic) or 647-689-4217 (International) and using conference ID 5562325. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 4,400 employees in approximately 100 locations. Visit Ryerson at www.ryerson.com.

Safe Harbor Provision

Certain statements made in this presentation and other written or oral statements made by or on behalf of the Company constitute "forward-looking statements" within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” "believes," "expects," "may," "estimates," "will," "should," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; fluctuating metal prices; our substantial indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; impacts and implications of adverse health events, including the COVID-19 pandemic; work stoppages; obligations under certain employee retirement benefit plans; the ownership of a majority of our equity securities by a single investor group; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2019, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

Media and Investor Contact:

Justine Carlson

312.292.5130

investorinfo@ryerson.com

For full release details see ir.ryerson.com.