CHICAGO – October 28, 2020 – Ryerson Holding Corporation (NYSE: RYI), a leading value-added processor and distributor of industrial metals, today reported results for the third quarter ended September 30, 2020.

Q3 2020 Highlights:

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included below in this news release.

Management Commentary

Eddie Lehner, Ryerson’s President and Chief Executive Officer, said, “I want to thank my Ryerson teammates, our customers, our suppliers and all essential workers as we continue to cohere and persevere together through the ongoing COVID-19 pandemic despite the omnipresent challenges and uncertainties in our communities and throughout the world during this public health crisis and resultant adverse economic impacts. Let me take a moment to recognize and summarize what Ryerson accomplished during the third quarter against tough odds in furthering our advancement as an organization. First and foremost, we looked after the safety, health, and well-being of our employees, customers, suppliers, and communities. We continued our work in pursuit of greater opportunity and social justice with care, commitment, and shared purpose. And, we notably improved our overall financial condition through a series of important accomplishments. We refinanced our long-term debt and triggered our first optional redemption feature decreasing annual cash interest expense by approximately $20 million. We took a significant step in further reducing legacy liability risk through an approximately $100 million pension obligation annuitization. We ended the quarter with our lowest net debt in more than ten years and highest liquidity levels of the year characterized by outstanding working capital and expense management. Central Steel & Wire Company, LLC, or CS&W, completed an arduous, but necessary ERP-system conversion during the last two months of the quarter whose impacts, while transitory, were not without effect. That said, CS&W took a major stride toward realizing its future potential. Most of all, I can’t say enough about our people and our culture through this period. There is a resiliency and undiminished enthusiasm in this organization to provide great customer experiences while looking out for one another and our communities in a manner reflective of the three immutable virtues of safety, health, and goodwill. This was an essential quarter of continued shared sacrifice performed brilliantly by essential people, thank you.”

Third Quarter Results

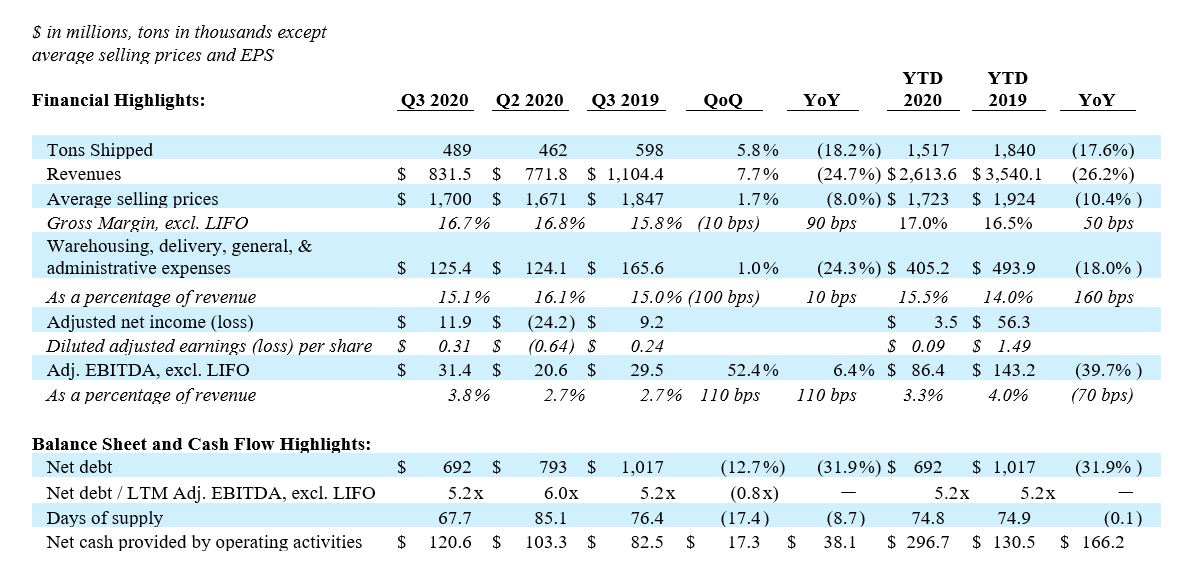

Ryerson achieved revenues of $832 million in the third quarter of 2020, an increase of 7.7 percent compared to $772 million for the second quarter of 2020, with tons shipped up 5.8 percent and average selling prices up 1.7. Gross margin expanded to 18.7 percent, compared to 15.0 percent for the second quarter of 2020 and 18.5 percent for the third quarter of 2019. Included in third quarter of 2020 cost of materials sold was LIFO income of $16.9 million, compared to LIFO expense of $14.1 million in the second quarter of 2020, and LIFO income of $29.6 million in the third quarter of 2019. Although managerial price margins expanded incrementally throughout the quarter, due to the impact of CS&W’s ERP conversion, gross margin, excluding LIFO decreased slightly to 16.7 percent in the third quarter of 2020 compared to 16.8 percent in the second quarter of 2020, but increased compared to 15.8 percent in the third quarter of 2019. A reconciliation of gross margin, excluding LIFO to gross margin is included below in this release.

In the third quarter of 2020, warehousing, delivery, selling, general, and administrative expenses remained largely flat on higher volumes, up by only $1.3 million, or 1.0 percent, compared to the second quarter of 2020. As a percentage of sales, warehousing, delivery, selling, general, and administrative expenses decreased to 15.1 percent in the third quarter of 2020 compared to 16.1 percent in the second quarter of 2020 as the increase in revenue outpaced expenses. Compared to the same quarter last year, Ryerson reduced warehousing, delivery, selling, and administrative expenses by $40.2 million, or 24.3 percent.

Net loss attributable to Ryerson Holding Corporation was $39.9 million, or $1.05 per diluted share, in the third quarter of 2020 compared to net income of $10.1 million, or $0.27 per diluted share, in the prior year period. Included in third quarter net loss is $52.5 million of a non-cash settlement accounting charge related to the annuitization of our pension liabilities and $17.1 million of expenses related to the refinance of Ryerson’s 2022 notes completed in July. Adjusted net income attributable to Ryerson Holding Corporation, excluding restructuring and other charges, gain or loss on retirement of debt, pension settlement charge, and the associated income taxes on these items, was $11.9 million for the third quarter of 2020, or $0.31 per diluted share compared to $9.2 million of adjusted net income, or $0.24 per diluted share, in the prior year period. Ryerson achieved Adjusted EBITDA, excluding LIFO of $31.4 million in the third quarter of 2020, an increase of $10.8 million compared to the second quarter of 2020 and an increase of $1.9 million compared to the third quarter of 2019. A reconciliation of Adjusted net income (loss) to net income (loss) attributable to Ryerson Holding Corporation and Adjusted EBITDA, excluding LIFO to net income (loss) attributable to Ryerson Holding Corporation is included below in this news release.

Nine Months Ended September 30, 2020, Financial Results

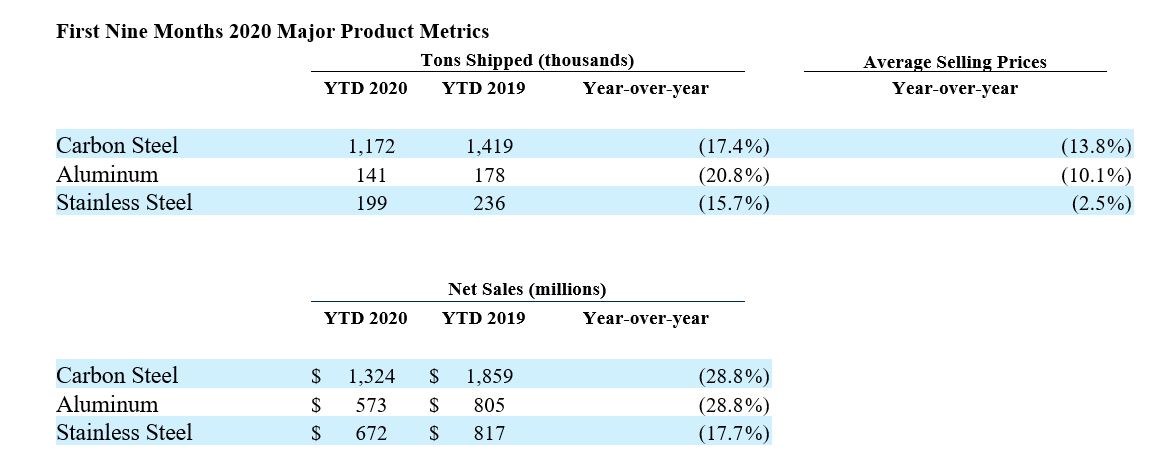

Revenues in the first nine months of 2020 were $2.61 billion, a decrease of 26.2 percent compared to the first nine months of 2019, as tons shipped decreased 17.6 percent and average selling prices decreased 10.4 percent. Net loss attributable to Ryerson Holding Corporation was $49.1 million, or a loss of $1.29 per diluted share, in the first nine months of 2020 compared to $56.0 million of net income, or $1.48 per diluted share, for the same period of 2019. Adjusted net income attributable to Ryerson Holding Corporation, excluding gain on insurance settlement, restructuring and other charges, gain or loss on retirement of debt, pension settlement charge, and the associated income taxes on these items, was $3.5 million for the first nine months of 2020, or $0.09 per diluted share compared to $56.3 million of income, or $1.49 per diluted share for the first nine months of 2019. Adjusted EBITDA, excluding LIFO was $86.4 million in the first nine months of 2020 compared to $143.2 million in the first nine months of 2019. Reconciliations of Adjusted EBITDA, excluding LIFO and adjusted net income to net income attributable to Ryerson Holding Corporation is included below in this news release.

Liquidity & Debt Management

Ryerson’s strong and responsive working capital management was clearly illustrated in the third quarter as the Company decreased inventory days of supply in-line with the market environment to 68 days, compared to 85 days at the end of the second quarter and 76 days at the end of the third quarter of 2019. The Company’s gap between the third quarter receivables and payables cycles also decreased sequentially, contributing to a cash conversion cycle of 70 days for the period, compared to 91 days for the second quarter and 80 days for the year-ago period.

Ryerson generated $120.6 million in cash from operating activities in the third quarter of 2020 driven by the aforementioned working capital and expense management execution as compared to $82.5 million in the year-ago period. The Company again significantly decreased its outstanding net debt during the third quarter, driving it down by over $100 million since June 30, 2020 to $692 million as of September 30, 2020, again achieving its lowest net debt in ten years. Additionally, in the third quarter of 2020, Ryerson completed an annuitization of approximately $100 million of pension participant liabilities and expects to realize economic savings of approximately $7.8 million on a net present value basis. As a result of the transaction, a remeasurement of the Ryerson U.S. pension liability was completed and resulted in a liability increase of $33 million, primarily driven by decreasing discount rates and lower long-term expected pension asset returns. Despite expenses related to the bond refinance, Ryerson retained a strong liquidity position of $398 million as of September 30, 2020, an increase of $48 million or 14 percent sequentially compared to $350 million as of June 30, 2020.

Molly Kannan, Controller and Chief Accounting Officer, said, “In the third quarter of 2020, we continued to execute on our COVID-19 policies by managing working capital and operating expenses exceedingly well, generating significant cash from operating activities and reducing net debt to historic levels. Additionally, we were pleased to announce the redemption of $50 million of our Senior Secured Notes due in 2028 to be executed on October 30th. This transaction is the first exercise of our optional redemption features secured in our recent refinance, and is expected to provide $4.25 million in annual interest expense savings on top of the approximately $16 million in annual interest expense savings from our recent bond refinancing in July. In all, our third quarter results illustrate our successful liquidity preservation and highlight the strengthening of our balance sheet.”

Outlook Commentary

Given the many pandemic induced uncertainties expected to continue through the balance of the year, the Company will not provide guidance for the fourth quarter ending December 31, 2020. We do note, however, that through the first several weeks of the fourth quarter, per day trends in revenue, gross margin, average selling prices, and volumes are moving higher relative to the third quarter as industrial metal commodity price drivers have improved along with restocking driven demand across a greater number of end markets.

Earnings Call Information

Ryerson will host a conference call to discuss its third quarter results Thursday, October 29, 2020 at 10 a.m. Eastern Time. Participants may access the conference call by dialing (866) 269-4260 (U.S. & Canada) / (856) 344-9206 (International)and using conference ID 5043925. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 3,900 employees in approximately 100 locations. Visit Ryerson at www.ryerson.com.

Safe Harbor Provision

Certain statements made in this presentation and other written or oral statements made by or on behalf of the Company constitute "forward-looking statements" within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” "believes," "expects," "may," "estimates," "will," "should," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; fluctuating metal prices; our substantial indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; impacts and implications of adverse health events, including the COVID-19 pandemic; work stoppages; obligations under certain employee retirement benefit plans; the ownership of a majority of our equity securities by a single investor group; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under "Risk Factors" in our annual report on Form 10-K for the year ended December 31, 2019, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

Media and Investor Contact:

Justine Carlson

312.292.5130

investorinfo@ryerson.com

For full release details see ir.ryerson.com.